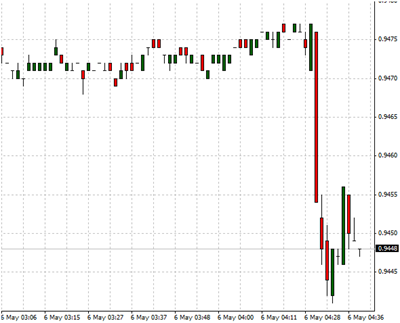

The Currency markets have reacted as expected below is the AUD/USD 1 min spot chart

The cash rate remains unchanged at 7.25% even though inflation remains high it looks like Reserve Bank is worried that another rise may slow the economy to much.

"The rise in Australia’s terms of trade currently occurring, which is larger than had been expected a couple of months ago, will work in the opposite direction. It will add substantially to national income and ability to spend, even with the slowing in global growth to below trend pace that the Bank has been assuming for some months now.

Given the opposing forces at work, considerable uncertainty remains about the outlook for demand and inflation. On balance, the Board’s current assessment is that demand growth will remain moderate this year. In the short term, inflation is likely to remain relatively high, but it should decline over time provided demand evolves as expected. Should demand not slow as expected or should expectations of high ongoing inflation begin to affect wage and price setting, that outlook would need to be reviewed.

Weighing up the available domestic and international information, the Board’s judgement is that the current stance of monetary policy remains appropriate for the time being. The Board will continue to evaluate prospects for economic activity and inflation in the light of new information."

Source: Reserve Bank Of Australia Media Release.

0 comments:

Post a Comment