Original Photography peteChon.

You will notice Wall Street Wit does not have a Blog Roll. This is because Blog Rolls are a big FAT waste of time and space. I would rather acknowledge worthy blogs and web sites with a review a rating and a link via a post. That way you the reader is not forced to blindly click on a link without knowing were you will end up. So without further a do here are my links and reviews for sites that rock out.

Five Star Sites

The Kirk Report: Website, Review.

EconBrowser: Website.

Alpha Trends: Website.

Portfolio News: Website.

Bloomberg: Website.

Four Star Sites

Timothy Sykes: Website, Review.

Michael Covel: Website.

Ugly Chart: Website.

Neural Market Trends: Website.

Howard Lindzon: Website.

The Disciplined Investor: Website.

TraderFeed: Website.

Maoxian: Website.

Crossing Wall Street: Website.

Three Star Sites

Trainee Trader: Website.

Afraid to Trade: Website.

Alea: Website.

Calculated Risk: Website.

Daily Options Report: Website.

Finance Viewpoint: Website.

Naked Capitalism: Website.

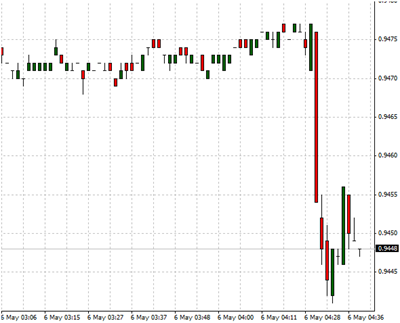

The Forex Project: Website.

Abnormal Returns: Website.

Wall Street Warrior: Website.

Note: I wont link to any site that has less then three star rating.